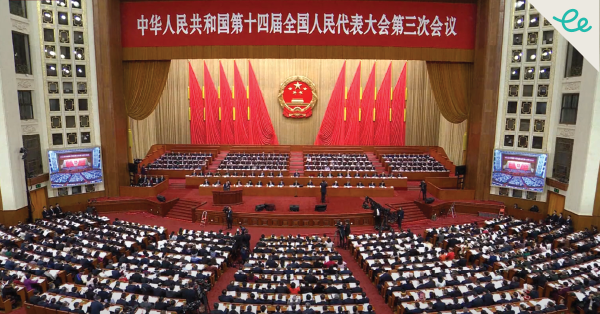

Every year, China’s National People’s Congress (NPC) and the Chinese People’s Political Consultative Conference—collectively known as the “Two Sessions”—offer crucial windows into Beijing’s economic and policy roadmap. This year’s gatherings have proven particularly significant as China navigates persistent economic headwinds while simultaneously pursuing ambitious technological advancement.

Unlock Critical Insights: Gain exclusive access to Enodo’s game-changing analysis and understand how this issue will reshape your world. Click below to register for a TRIAL ACCESS to our premium research.

Walking the Streets of Shanghai: What the Government Work Report Doesn’t Tell You

While international media fixated on China’s GDP target of “around 5%” announced in the Government Work Report by Premier Li Qiang, the more revealing stories were unfolding in shopping malls and on city streets across the country.

During our team’s visit to Jiangsu province last December—one of countless field trips we make throughout the year—we witnessed something remarkable: local governments had dramatically expanded their consumer electronics subsidy programs. Even premium products like the iPhone 16 Pro were selling out immediately thanks to subsidies reaching 15% of purchase price.

“Sold out!” was the consistent response from store clerks when we inquired about the latest devices. This wasn’t isolated to Jiangsu; we observed similar trends in Shanghai and Zhejiang.

These observations on the ground reveal Beijing’s commitment to consumption in ways that formal announcements often understate. The expanded subsidy programs represent just one facet of a multi-pronged approach to stabilize the Chinese economy.

Unexpected Winners: Civil Servants and Their Spending Power

Another insight from our field research that wouldn’t make headlines: civil servants received their first significant pay raise in years—approximately 5%. This may seem modest, but it represents a major shift in fiscal policy.

As one veteran civil servant told us over dinner during a recent trip: “The last time I saw a raise like this was in 2015.” With an estimated 48 million civil servants and public employees in China, plus their families totaling nearly 200 million people, this group could significantly boost domestic demand.

Why focus on civil servants? Our conversations revealed a simple rationale: since many of their essential needs like housing and healthcare are covered by the state, additional income is more likely to be spent than saved—precisely what the China economic outlook needs right now.

The NPC’s Fiscal Blueprint: Reading Between the Lines

The 2025 budget unveiled during the NPC sets a deficit ratio of 4% of GDP—up from 3% in 2024—confirming the shift toward a more expansionary fiscal stance. The ultra-long Special Treasury Bond issuance of Rmb1.3trn, while substantial, fell short of some market expectations.

What explains this calibration? Our analysis suggests Beijing is keeping some powder dry for potential escalation of trade tensions following recent US policy shifts. This strategic restraint reflects a careful balancing act rather than reluctance to stabilize the economy.

Technology and National Confidence: The Overlooked Narrative

While economic reforms dominated official discussions, our February trip revealed an unexpected undercurrent: a quiet national confidence powered by China’s technological advances. The excitement around DeepSeek—a homegrown AI breakthrough—was palpable in conversations with locals in tier-one cities.

This technological progress is providing political capital for Beijing to pursue longer-term economic goals without resorting to drastic nationalist measures. As one tech professional explained to us: “Even with economic challenges, seeing Chinese tech compete globally gives us confidence in the country’s direction.”

The Challenge of Balancing Growth and Reforms

Xi Jinping’s economic policy vision, reaffirmed during the Two Sessions, continues to emphasize quality over quantity. The government’s commitment to “vigorously boost consumption” while maintaining fiscal discipline represents a delicate balancing act.

The State Council followed the NPC with the announcement of thirty measures to boost consumption. These measures include both immediate action and long-term structural reforms that have the potential to reshape China’s growth model.

Military Budget and Foreign Policy: Measured Increases

While economic matters dominated discussions, China announced a 7.2% increase in its military budget—continuing a pattern of modest annual increases. Taiwan and Hong Kong received expected mentions, but with little deviation from established positions.

The measured approach to military spending and foreign policy topics suggests Beijing remains primarily focused on domestic economic challenges rather than external posturing.

What’s Next for China’s Economic Outlook?

Looking ahead, several key factors will determine the success of China’s economic strategy:

- Whether increased income for civil servants and vulnerable groups can offset spending constraints on more affluent consumers

- The effectiveness of housing market stabilization measures and support for the equity market in restoring consumer confidence

- The pace at which technological breakthroughs translate into commercial applications and job creation

Our regular on-the-ground research gives us unique insight into how these dynamics are unfolding in real-time—insights that often contradict or complement mainstream analysis based solely on official statistics.

Beyond the Headlines

While international coverage focuses on headline numbers like the 5% growth target, the real story of China’s economic direction lies in the details of policy implementation and public response. From expanded consumer subsidies to public sector pay raises, from technological breakthroughs to housing market interventions, these interconnected measures represent a comprehensive approach to economic stability.

By maintaining regular presence in China’s cities and provinces, speaking directly with everyone from civil servants to bank employees to shopkeepers, we continue to identify the under-the-radar trends that shape China’s economic trajectory before they become apparent in official data or international reporting.

Understanding these nuances is essential for anyone seeking to navigate the opportunities and challenges presented by the world’s second-largest economy in 2025 and beyond.

This blog post is based on Enodo’s extensive on-the-ground research conducted through regular trips to China, where our team engages directly with individuals across various sectors of the economy to gain first-hand insights that complement and often precede official data.

Unlock Critical Insights: Gain exclusive access to Enodo’s game-changing analysis and understand how this issue will reshape your world. Click below to register for a TRIAL ACCESS to our premium research.

Related Reports:

Riding the Dragon: China’s Stock Market Roars Back Into Life

China Gears up for Crucial Third Party Plenum

China’s National People’s Congress: Insights and Implications